Understanding Cap Rates: Navigating Multifamily Investment in High-Interest Rate Environments

The Other Day, Someone Asked Me…

Multifamily investing involves the acquisition and management of properties that have multiple rental units, such as duplexes, triplexes, or apartment complexes. Unlike single-family homes, which consist of a single unit, multifamily properties offer the opportunity to earn income from multiple tenants within a single property. This aspect makes multifamily investing an appealing option for individuals seeking cash flow and long-term appreciation.

So, let’s break it down.

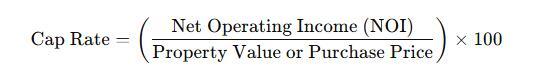

A capitalization rate (cap rate) is a simple yet powerful formula used to evaluate a real estate investment’s potential return. It’s calculated as:

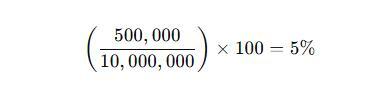

For example, if a property generates $500,000 in NOI and is valued at $10 million, the cap rate would be:

In simple terms, the cap rate tells you how much income a property generates relative to its cost.

Why Do Cap Rates Matter?

Cap rates serve multiple functions in multifamily real estate investing:

- ✔ Comparing Investments: A 5% cap rate property may have different risk and return potential than a 7% cap rate property.

- ✔ Assessing Risk: A lower cap rate often signals lower risk (but lower returns), while a higher cap rate can mean higher potential returns but also higher risk.

- ✔ Understanding Market Perception: Cap rates are influenced by location, demand, and investor confidence—not just property income.

- ✔ Adjusting for Economic Conditions: Interest rates, inflation, and rental demand all impact cap rates, making them crucial in shifting markets.

Cap Rates in a High-Interest Rate Environment

When interest rates rise, borrowing costs increase, impacting property valuations and pushing cap rates higher. Here’s why:

Higher Interest Rates → Higher Cap Rates

- Investors demand higher returns to offset increased financing costs.

- Property values may decline as buyers are unwilling to pay high prices for low cap rate deals.

Low-Interest Environments → Lower Cap Rates

- Cheap borrowing encourages higher property valuations.

- Investors accept lower returns due to low financing costs.

Key Takeaway: In high-interest rate markets, investors should adjust their expectations and seek properties that offer higher cap rates to maintain profitability.

What Factors Influence Cap Rates?

Several elements affect cap rates, particularly in a high-interest rate climate:

- Interest Rates: Higher borrowing costs typically push cap rates up.

- Property Location: Prime locations often have lower cap rates due to stability and demand.

- Market Demand: High-demand areas see compressed cap rates as investors accept lower returns for security.

- Property Condition & Age: Well-maintained properties in growth areas command lower cap rates.

- Risk Perception: Properties with higher risk factors (e.g., weak tenant base, unstable cash flow) demand higher cap rates to attract investors.

Finding the Right Balance: Risk vs. Return

Not all cap rates are created equal. A “good” cap rate depends on:

- ✔ Your Investment Goals – Are you looking for cash flow or long-term appreciation?

- ✔ Market Conditions – Are you in a stable or volatile economic cycle?

- ✔ Financing Costs – How does the cost of debt impact returns?

- ✔ Property-Specific Risks – Is the asset in a strong rental market with low vacancy?

General Rule of Thumb:

- Class A properties in prime markets → Lower cap rates (3%–5%).

- Class B/C properties in secondary markets → Higher cap rates (6%–10%+).

How to Secure Favorable Cap Rates in High-Interest Markets

To navigate high-interest rate environments, investors can use these strategies:

- Look for Value-Add Properties – Investing in properties with renovation potential can boost NOI, increasing cap rates.

- Negotiate Purchase Prices – Higher interest rates often create motivated sellers, allowing you to negotiate better deals.

- Explore Alternative Financing – Seller financing or interest rate buydowns can mitigate high mortgage costs.

- Optimize Property Operations – Reducing expenses and increasing rents can improve NOI, keeping returns healthy.

- Diversify Across Markets – Investing in multiple locations can help offset cap rate fluctuations.

Cap Rates as Part of Your Overall Investment Strategy

Cap rates should never be viewed in isolation. Instead, consider them within the broader context of your portfolio and exit strategy:

- Portfolio Diversification: Balancing risk across different property types and markets.

- Long-Term Appreciation: Evaluating future market growth potential beyond the cap rate.

- Exit Strategy: Considering cap rates when selling or refinancing properties.

- Professional Guidance: Working with real estate professionals to assess deals comprehensively.

Final Thoughts: Cap Rates & Smart Multifamily Investing

Cap rates are a key metric in evaluating multifamily real estate, but they shouldn’t be the sole deciding factor. In a high-interest rate market, investors must:

- ✔ Adjust their return expectations

- ✔ Focus on value-add and cash flow opportunities

- ✔ Stay informed about market trends

Bottom Line: A “good” cap rate depends on the investment’s risk, location, and financial structure—not just the number itself.

Want to Invest in Multifamily Real Estate?

Join Our Investor Club to gain access to institutional-grade multifamily opportunities that are structured to navigate changing market conditions.

Why Join Our Investor Club?

- ✔ Priority access to expert-vetted real estate investments

- ✔ Passive income opportunities—professionally managed deals

- ✔ Exclusive insights on how to invest in any market cycle

Don’t sit on the sidelines—start investing today!

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or tax advice. All investments carry risk, and past performance does not guarantee future results. Investors should conduct their own due diligence and consult with a qualified financial or legal professional before making any investment decisions.